PERSONAL & BUSINESS SOLUTIONS

Wealth Protection and Accumulation

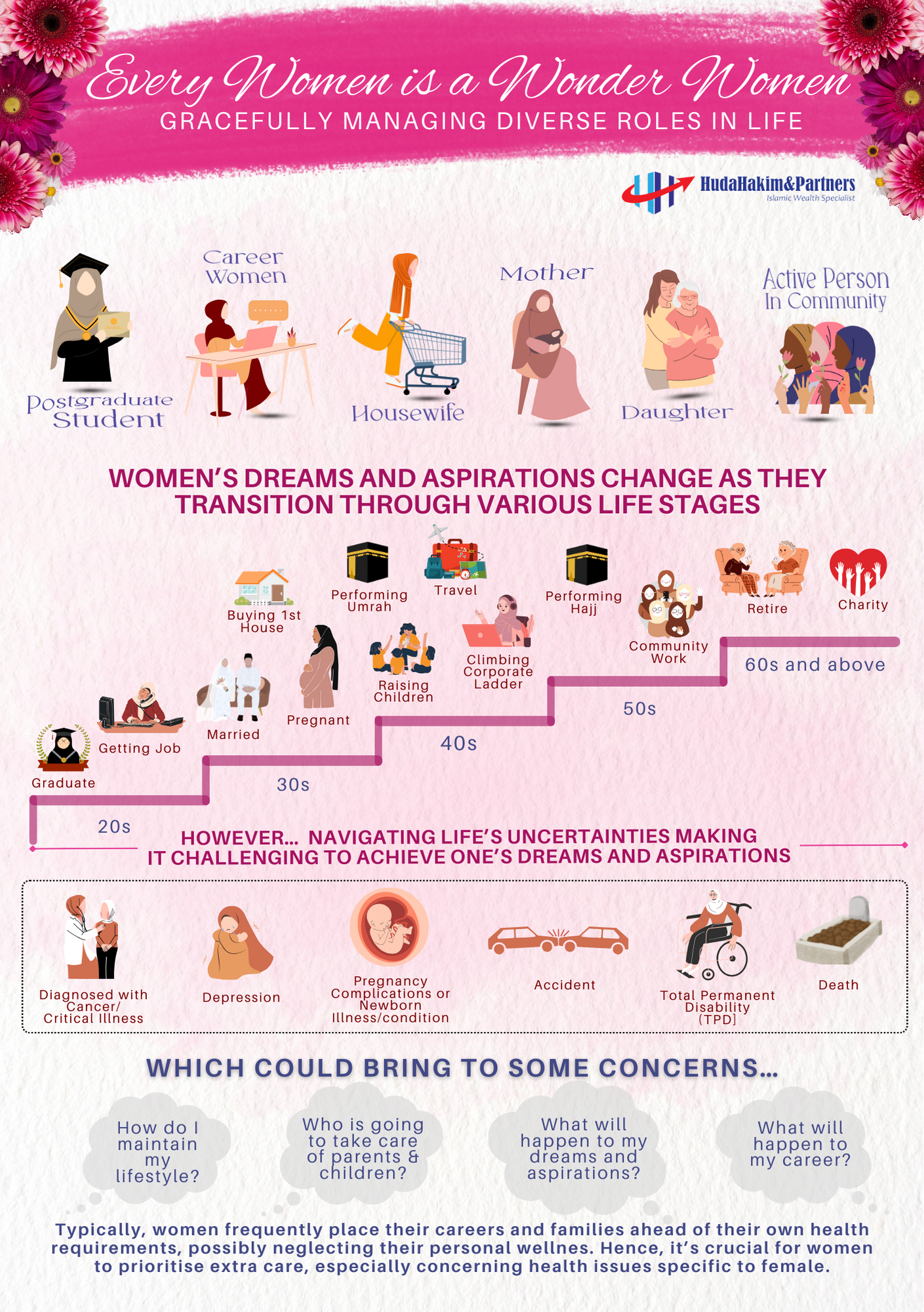

Wealth protection and accumulation is the first pillar of wealth planning and the most important Pillar of Wealth. Without adequate protection, you will be vulnerable to life’s unexpected misfortunes – throwing you and your family in limbo, suffering unnecessarily, and facing tremendous financial losses. Our customized planning packages can reduce the negative impact of life’s curveballs and ensure that your lifestyle remains unaffected as much as possible thereafter.

Our consultation considers financial support for your family if you pass on and from temporary/long-term disability and critical illness. We will give guidance on how to cover hospitalisation expenses with Takaful, secure an income if you require long-term care, and ensure financial protection from accidents. You can also accumulate wealth as Takaful plans have savings and investment features.

The benefits of planning your wealth protection are:

- Financial security

- By having appropriate contingency plans in place, you can safeguard your family’s financial well-being to face unexpected events such as disability, critical illness, or death and accumulate your wealth.

- Income continuity

- Wealth protection planning involves considering scenarios where your ability to earn an income may be compromised. By having appropriate coverage, such as disability or income protection plans, you can help replace lost income and maintain financial stability for you and your family during challenging times.

- Tax optimization

- Effective wealth protection planning considers tax implications and seeks to optimize your tax position. By strategically structuring your investments and Takaful certificates, you can minimize tax liabilities, preserve wealth, and enhance overall returns.

- Peace of mind

- Knowing that you have taken steps to protect your family’s financial future can alleviate stress and provide a sense of security. It allows you to focus on other aspects of life with the assurance that you have prepared for the unexpected.

As a responsible family-first individual, wealth protection planning should be your priority.