PERSONAL & BUSINESS SOLUTIONS

Wealth Enhancement and Preservation

Most people spend their lives accumulating wealth, yet ignore the importance of enhancing and preserving it. It is essential to find a healthy balance between the two and know when and how to focus on each, not only for your financial stability but for your loved ones too.

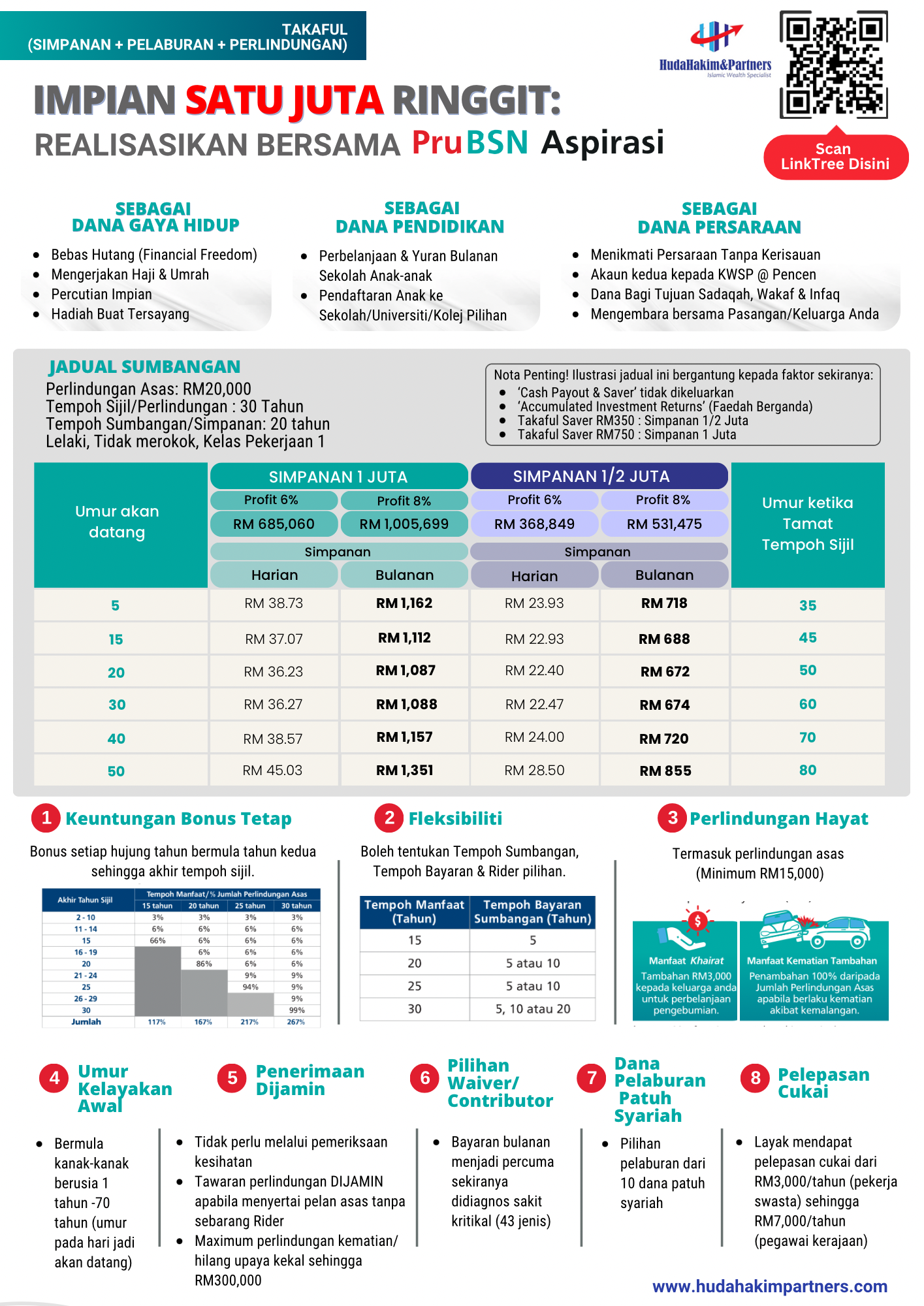

For income preservation, a good strategy is to have Takaful plans. They work as a monetary cushion during financially difficult times, providing coverage against death, total permanent disability, partial disabilities, critical illnesses, medical/health related injuries, accidents, etc. You can also safeguard your wealth by saving it through bonds/sukuk funds or other similar options.

For wealth enhancement, the strategy changes according to your portfolio and financial standing, with a view towards retirement and legacy planning as well as education planning for your children. Diversifying your portfolio by monitoring the market for better investment options is highly encouraged.

Some investment tools and financial instruments to enhance your wealth are long-term unit trust, gold, and property investments. Our wealth planners are adept at advising the right combination of investments for you.

Here are the main benefits of wealth enhancement and preservation:

- Enhanced wealth accumulation

- Wealth enhancement and preservation plans involve strategic investment strategies, such as diversification, asset allocation, and active management, aimed at maximising returns. You will have the potential to generate higher investment gains and grow your wealth more rapidly.

- Risk management

- By spreading your investments, you reduce the impact of any one investment’s performance on your overall portfolio. Our wealth managers can also help assess your risk tolerance and develop an investment strategy that aligns with your goals and risk appetite.

- Retirement and legacy planning

- These plans can help you build a retirement nest egg by considering your long-term financial goals and incorporating strategies to accumulate wealth. You can enhance your retirement savings and ensure your loved ones are cared for during your post-working years.

- Education planning

- Your mid- to long-term strategies can also include your children’s education planning to ensure they have a strong footing into tertiary education and adult working life.

- Financial security and peace of mind

- By actively managing and enhancing your wealth, you can gain confidence in your financial future as you have taken the steps to protect and grow your assets. This peace of mind lets you focus on other aspects of your life without undue financial stress or worry.

Ready to preserve and enhance your wealth?